Member Info

Contract and

FAP Licence Structure

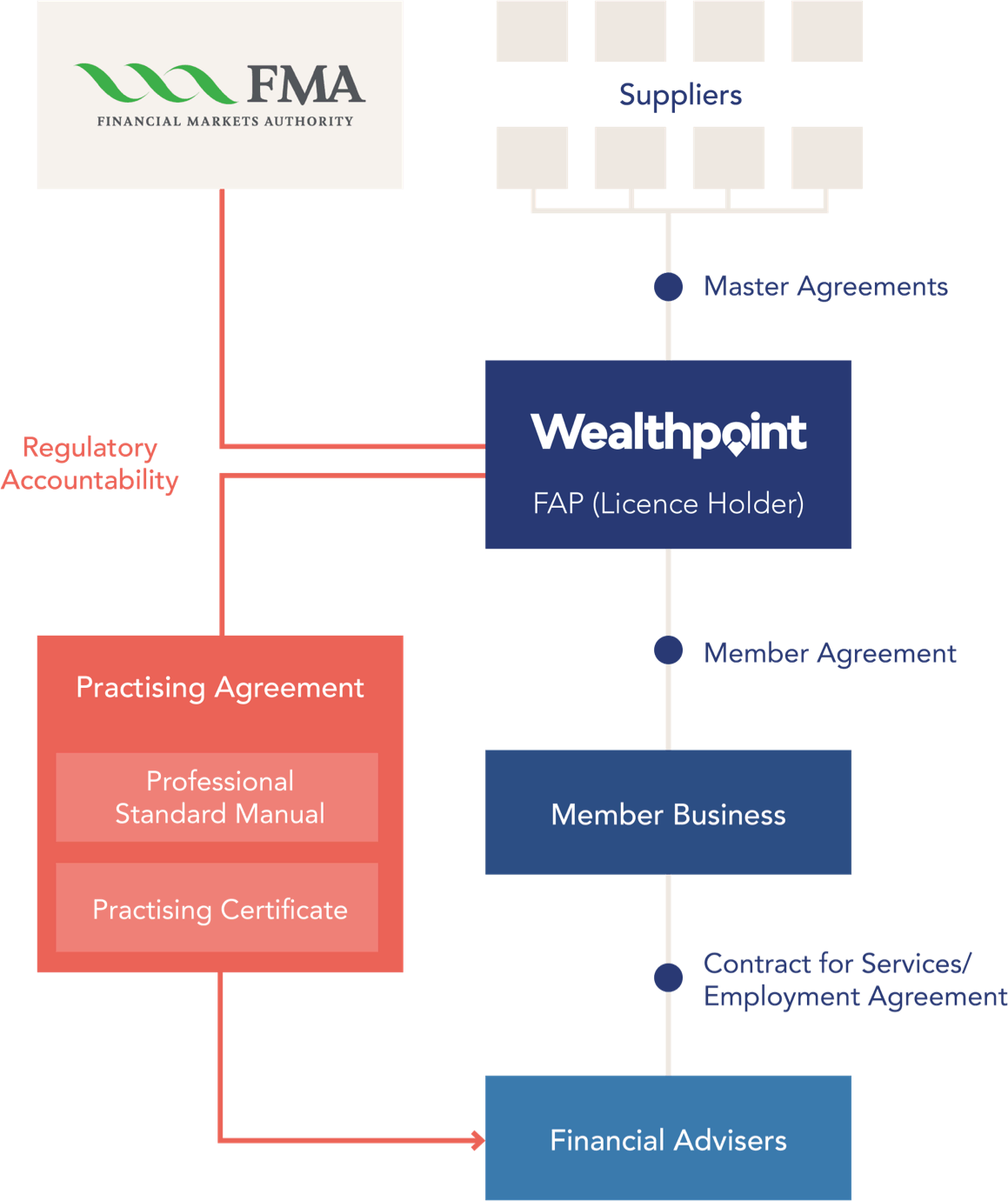

There are three key agreements that govern the relationships between Wealthpoint, suppliers, member businesses and advisers. These set out both the commercial and regulatory rights and obligations of each party. The three agreements are shown below.

License Operating Model

Our Key Agreements

-

1

Master Distribution Agreements

Wealthpoint maintains an Approved Products List (APL) managed by an adviser-led Product Committee. All suppliers on the APL contract directly to Wealthpoint through Master Distribution Agreements, rather than directly with member businesses or individual advisers. This structure delivers significant benefits to members as it ensures all members can maintain access to suppliers – some of which have indicated they will not contract with individual advisers or small advisory businesses.

This structure also supports centralised remuneration management processes. Wealthpoint manages the receipt of commissions from close to 50 suppliers, on-pays member businesses and provides a commission management tool to help member businesses analyse and distribute remuneration to the correct advisers in their business.

-

2

Wealthpoint Member Agreement

The Member Agreement covers all aspects of the relationship between Wealthpoint and the member business including their rights as a shareholder in the co-operative, entry and exit terms, maintaining client ownership and their oversight responsibilities to ensure their advisers comply with Wealthpoint’s FAP licence obligations.

-

3

Adviser Practicing Agreement

Wealthpoint maintains compliance oversight of financial advisers through a Practicing Agreement held directly with individual advisers. Adviser compliance obligations are set out in a Professional Standards Manual and advisers must satisfy ongoing quality assurance assessment and professional development requirements in order to maintain a Wealthpoint Practicing Certificate.

One unique feature of Wealthpoint’s regulatory compliance model is that our advisers operate directly under our FAP license and are not required to be an Authorised Body or become a Financial Advice Provider themselves. We believe this greatly reduces compliance costs, simplifies operational compliance and also provides better outcomes for clients.